PROVIDENCE, R.I. – Attorney General Peter F. Neronha warns of Internal Revenue Service (IRS) imposter scams during the current tax season as state and federal tax deadlines approach during the month of April.

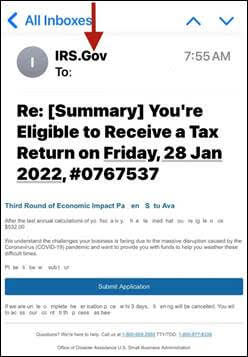

The Office of the Attorney General has received multiple reports of phone and email IRS imposter scams that attempt to solicit personal and payment information from individuals.

Scammers use a variety of methods in their attempts to victimize Rhode Islanders, including phone calls, texts, emails, regular mail, and social media messaging. The common elements of these imposter scams are: 1) a solicitation made to appear as if generated from a familiar government or business entity, like the IRS, and 2) a request for personal information or payment.

“Unfortunately, these types of imposter scams are all too prevalent. The best way Rhode Islanders can avoid falling victim to a scam is to stay educated about the methods and themes scammers employ,” said Attorney General Neronha. “Each year during ‘tax season,’ we see an uptick in IRS imposter scams directed at earnest taxpayers who are simply trying to do the right thing. Rhode Islanders can always turn to this office for advice and information if they are faced with a possible scam situation.”

Imposter scams are commonplace – messages pretending to originate from a familiar or trusted source can convey a false sense of confidence to the recipient who in turn may be more likely to respond to a request and share personal or even payment information. Scammers are keen to take advantage of current trends and tailor their scams to target individuals – such as IRS scams during “tax season.”

Rhode Islanders should keep the following tips in mind when presented with messages purporting to be from a familiar government or business entity:

- The IRS does not initiate contact with taxpayers by email, text messages, or social media channels to request personal or financial information. The IRS will also not call to demand immediate payment or threaten law enforcement action.

- Be a skeptic – if the form of communication, type of language or grammar, or basic reason for the request does not seem to be right, assume you are dealing with a scam attempt.

- Ignore – decline an unfamiliar call or delete a suspicious email and under no circumstances reply or call back.

- If you do answer a call or open an email, do not engage – do not answer questions or click any links.

- Communicate with the familiar government or business entity using contact information provided on bills, statements, cards, or official websites.

- When in doubt, contact the Office of the Attorney General for advice on how to deal with potential scams.

To report the scam to the Attorney General’s consumer protection team, call 401-274-4400 or visit riag.ri.gov. Consumers are also encouraged to consult www.irs.gov for additional IRS imposter scam information.

This is a test