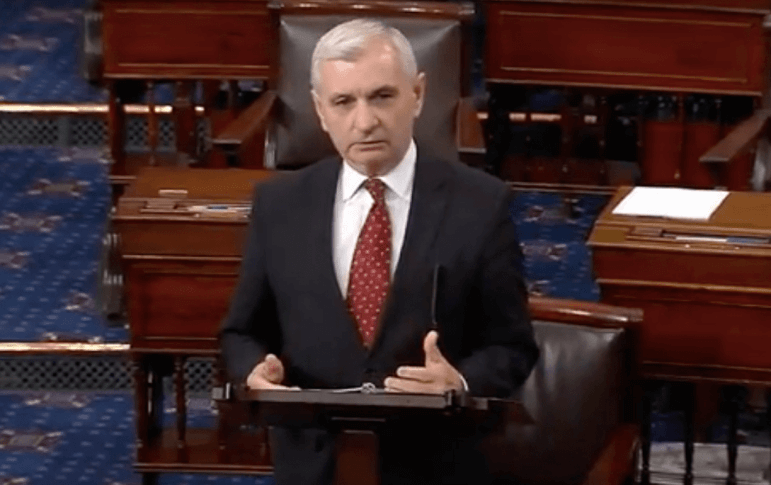

![[CREDIT: US Sen. Jack Reed] US Sen. Jack Reed asked his fellow Senators to consider consumer's rights to defend themselves from big bank and financial institutional fraud on the Senate floor.](https://e8dgfhu6pow.exactdn.com/wp-content/uploads/2017/10/Reed-Senate-CFPB-rule-350x220.png?strip=all&lossy=1&ssl=1&fit=350%2C220)

“At a time when millions of Americans are suffering abusive practices by major financial institutions, including massive consumer fraud by Wells Fargo, and the exposure of up to half of the national population’s personal information due to inadequate cyber security by Equifax, it is simply wrong to give immunity to bad corporate actors against lawsuits by the very customers they harmed,” said Sen. Jack Reed on the Senate floor speaking against removing the rule.

“I urge my colleagues to think about the millions of Americans who still don’t know all the facts about whether they are victims of one of these or other major banking scandals, and deserve the chance to gather the facts and hold the responsible parties accountable. This anti-consumer resolution strips away those victims’ Constitutional first line of defense against lending fraud and permits corporations more opportunities to take advantage of consumers,” Reed said.

But Reed’s words were heeded only by half of the Senate, which was locked in a 50-50 tie broken by Vice President Mike Pence’s vote, described by Sen. Elizabeth Warren, the former, inaugural director of the Consumer Financial Protection Bureau, as a “wet kiss” to Wall Street.

Attorney General Peter F. Kilmartin called the vote by the United States Senate repealing the Consumer Financial Protection Bureau’s Arbitration Rule shameful, effectively stripping consumer from their rights to file class-action lawsuits against financial institutions.

“It has been the long-standing practice of financial institutions to include arbitration clauses into the fine print of contracts to bar individuals from engaging in class-action lawsuits. By forcing people into private arbitration versus a class-action lawsuit, the clauses effectively take away one of the few tools that individuals have to fight predatory and deceptive business practices. Arbitration clauses have derailed claims of financial gouging, discrimination in car sales and unfair fees,” Kilmartin said.

“This is the first step towards the Republican agenda to dismantle the CFPB entirely and effectively let Wall Street run amok and write the rules as they see fit. The Republicans are so gun-ho to get rid of the CFPB simply because it was an Obama initiative, they refuse to admit that the Bureau has established common sense regulations that protect consumers, and that these regulations have not stopped a single company from making a profit. We have not learned from the recent history of the banking crisis and financial meltdown of the Great Recession. The fact is that financial institutions cannot be trusted to act without proper oversight,” Kilmartin said.

Initially after the Equifax breach exposing half of American’s financial information, Kilmartin pointed out, Equifax required all consumers who signed up for the company’s Trusted ID credit monitoring service to accept specific terms and conditions, including arbitration, before being permitted to register for the service. It was only after tremendous pressure by attorneys general and consumers that Equifax agreed to waive the condition.

“We’d all like to think that companies will always do right by the consumer and would never employ deceptive or predatory practices to make profit, but that’s just not reality. We need someone to keep an eye out for the consumer and to make sure companies- especially our financial institutions who have a history of playing fast and loose – do right by consumers, and if not, allow the consumers to seek relief in the proper venue,” Kilmartin added.

This is a test